The Middle East—a region with burgeoning economies and strategic trade routes is a highly attractive market for exporters worldwide. However, exporting to this region demands a clear grasp of the necessary documentation, agencies, and approvals. Here, we provide an in-depth look at the essentials for exporting to GCC nations.

The Importance of Being Prepared

Shipping goods to the Middle East entails more than logistics. Success requires mastering regional regulations, cultural nuances, and approval protocols. Detailed readiness helps avoid delays or costly setbacks in each unique GCC market.

Essential Paperwork for GCC Trade

Although each country has its individual regulations, several documents are commonly required:

1. Sales Invoice: A fundamental record outlining goods sold, their value, and contractual terms. Correctness is essential to avoid delays.

2. Packing List: Includes a breakdown of the shipment’s contents, dimensions, and weight.

3. Origin Certification: Issued by authorized bodies, this document confirms the goods’ origin.

4. Bill of Lading (BOL): A legal document from the carrier confirming shipment details.

5. Import Permits: Mandatory for restricted or controlled product categories.

6. Compliance with Local Standards: Conforming to local technical norms is non-negotiable for entry.

Understanding Regulatory Bodies and Obtaining Approvals

Various agencies oversee import regulations in GCC countries. Below is a breakdown of these agencies by country:

Saudi Arabia

Saudi Arabia’s size and economic influence come with robust trade regulations.

• Oversight by the SFDA: Manages food, pharmaceuticals, medical devices, and cosmetics.

• SASO Standards Body: Imposes Certificate of Conformity (CoC) requirements for specific goods.

• Zakat, Tax, and Customs Authority: Oversees the entry of goods into the kingdom.

Trade in the UAE

Exporting to the UAE entails both opportunities and meticulous adherence to rules.

• Dubai’s Regulatory Framework: Mandates bilingual labeling (Arabic and English).

• Oversight by MOCCAE: Focuses on sustainability-related trade regulations.

• FCA’s Role in Import Approvals: Streamlines customs declarations through digital platforms.

Trade with Qatar

Exporting to Qatar requires understanding its regulatory landscape.

• MOCI Oversight in Qatar: Ensures conformity with national trade laws.

• Qatar General Organization for Standards and Metrology (QS): Governs technical standards enforcement.

• Qatar Customs Clearance: Monitors all customs-related activities and paperwork.

Trade Opportunities in Bahrain

Exporting to Bahrain requires understanding its simplified trade landscape.

• Customs Operations in Bahrain: Simplifies trade with e-government solutions.

• MOIC in Bahrain: Oversees trade licensing and product registrations.

• BSMD’s Role in Trade: Imposes regulations for specific product categories.

Navigating Kuwait’s Trade Requirements

Trade with Kuwait emphasizes quality and compliance.

• Kuwait’s Customs Authority: Monitors HS code accuracy and COO compliance.

• PAI and Product Standards: Handles product conformity and industrial licensing.

• Kuwait’s Trade Ministry: Supervises trade licensing and approvals for regulated goods.

Oman

The importation process in Oman includes:

• Ministry of Commerce, Industry, and Investment Promotion (MOCIIP): Regulates trade and ensures products meet Omani standards.

• DGSM is responsible for conformity evaluations and technical regulations.

• Royal Oman Police - Customs Directorate: Oversees customs clearance, requiring complete and accurate documentation.

Important Considerations for Exporting to Specific Countries

Requirements for Product Labeling and Packaging

Each GCC country has distinct labeling and packaging requirements:

• Arabic is required on all labels, but bilingual labels in Arabic and English are often advantageous.

• Product labels are required to detail the name, origin, ingredient list, expiration date, and safety notices.

• Packaging: Must meet local environmental regulations, such as biodegradable packaging in Saudi Arabia.

Restricted and Prohibited Goods

Certain items are restricted or prohibited in the GCC:

• Religious Sensitivities: Items that are offensive to Islamic culture are banned.

• Alcohol and Pork: Strictly controlled or prohibited in many GCC countries.

• Pharmaceuticals and Chemicals: Require special permits and approvals.

Taxes and Tariff Policies

Most GCC countries adhere to the GCC Customs Union’s unified tariff structure, imposing 5% on most imports. website However, some items, such as agricultural and luxury products, have varying rates.

Challenges Exporters May Face in the Middle Eastern Market

1. Navigating cultural nuances and business protocols is vital.

2. Regulatory Complexity: Each country’s unique requirements necessitate meticulous planning.

3. Mistakes in documentation may cause substantial hold-ups.

4. Standards in the region are constantly updated, necessitating vigilance.

Tips for Successful Exporting

1. Engage Local Partners: Collaborating with local distributors or agents can simplify the process and ensure compliance.

2. Utilize GCC free zones for reduced regulations and tax advantages.

3. Employ online systems like FASAH (Saudi Arabia) and UAE e-Services to optimize customs procedures.

4. Seek Professional Assistance: Partnering with trade consultants or freight forwarders can help navigate complex procedures.

Wrapping Up

Success in exporting to the GCC demands preparation and a firm grasp of country-specific standards.

By maintaining precision in documentation, aligning with local regulations, and utilizing regional resources, exporters can thrive.

With a well-thought-out strategy and thorough execution, companies can succeed in the Middle East.

Haley Joel Osment Then & Now!

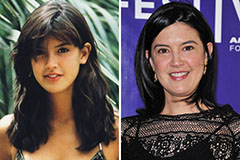

Haley Joel Osment Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!